Part 1: Going, going, gone. Bye bye savings.

In April 2024, I bought an abandoned bank in West Wales. It’s fair to say that I had no idea what I was doing, only that the place needed saving, and saving in a way that would benefit the whole community.

Sadly, it wasn’t just a case of dropping some money on the desk of a landlord and grabbing the keys. The first step to buying the place was an auction. This was done ebay-style online with anonymous bidders putting their maximum bids into the tempting little text box on the screen and then waiting to see if you’d be outbid. I had a finite budget, so I was acutely aware of every keypress I made as the clock ticked down. I had a pretty good idea of what the reserve price was going to be, so in the first hour of the 48 hour auction, I made a bid which would cover that. I then turned off my computer and avoided that webpage for the next 47 hours.

When I came back, I found there were two people bidding against me, so I waited until the countdown said ‘2 minutes’ and I increased my bid. Within 40 seconds I was outbid. So I increased my number again. I was outbid. If anyone bids within the final 90 seconds of the auction, the clock is reset, so there is always time to revise up. When the clock said 93 seconds I hit ‘Send’ on my maximum bid. I had a small contingency, but knew that going into that would mean struggling to do the repairs and alterations the building needed.

Slowly, I watched the number on the timer get smaller and smaller. Expecting with every passing second there would be a new bid and I would have lost (there were some really good reasons I coudn’t stand to lose, which we’ll get to later). It passed 10 seconds, then down and down it went until the number was replaced with ‘You won!’ and I was going to use pretty much all my savings to buy a 150 year old building that had been unloved for five years.

29 days later, a friend went to the solicitors office to pick up the keys. I was on holiday, so wouldn’t get a chance to really assess what I had bought for another week.

When I got home, that’s when the stress began. And the panic attacks. And the late night phone calls where my throat was so dry from fear that I could barely speak. For one whole week, I was absolutely certain I had made the worst decision of my life and it was one I would not be able to back out of without losing a ton of money. My life savings.

Part 2: Let’s see what I’ve bought

Fortunately, I wasn’t coming into this blind.

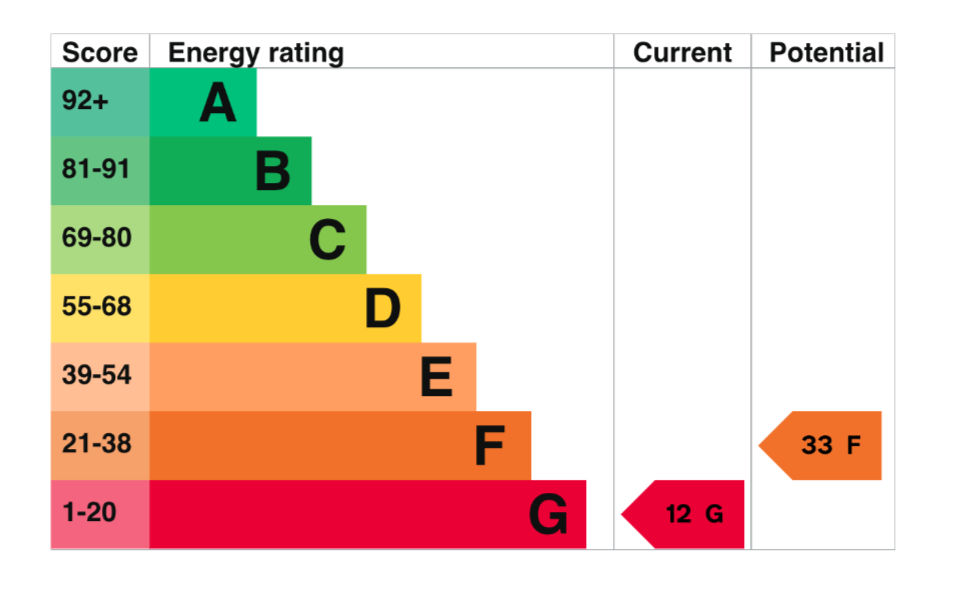

In 2019, I bought the flat above the bank. It had a 110 year lease and – I didn’t know it at the time – was not actually eligible to be leased due to its terrible EPC certificate. In the winter it was cold and expensive, and in the summer it was cold and expensive.

There’ll be more on this later, but having had one absentee landlord, I didn’t want another. I had also started talking with a potential tenant and a community group about their needs and how they could all fit into one building before I made the bid, so I knew there were actual projects riding on me being successful.

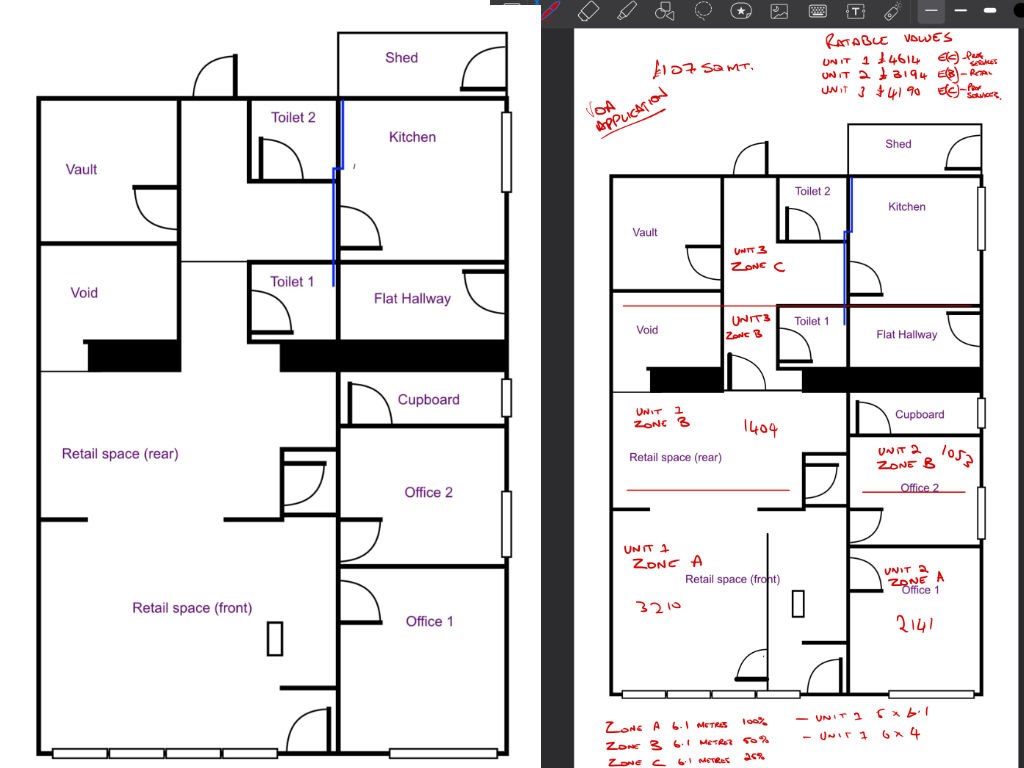

I went in that first day with a tape measure and a plan to divide the space into three. This was vital, because from the moment I owned the place, I was responsible for the rates. And the rates were £600 per month.

Let’s not think about the madness of someone leaving it empty for FIVE YEARS and paying those rates without really attempting to come up with a solution.

Anyway, I made a miscalculation. I assumed that the ‘rates grace period’ of three months would begin on the day I bought the place. But in fact, that period began as soon as the property was vacated in 2018.

It took me two weeks to measure the place, work out the best method of division and submit plans to the now-defunct Valuations Office Agency (VOA) and get their approval for the split. In the meantime, work began building the walls that would create the internal spaces, and I signed a Meanwhile lease with one tenant (more on that later) and a transition lease with a second tenant. The second tenant was held in an existing lease for one year before she could move, so I created a lease that allowed her to rent the space – while I could use it to manage the transition – without significant cost.

I finally got the split notification from the VOA on August 1st, but it was valid from the date of submission, so I was only responsible for two weeks of full rates for the building.

Quick note. If you’re doing a commercial building split with the VOA (or whatever replaces it), your local council will most likely want to be involved. While they might be useful in some circumstances, they tend to be a brake on the application, so if time is of the essence, I would recommend going direct. The council will still be informed about the process and the decision, but you might save yourself a few weeks of time. In my case, every week would cost me £150, so I couldn’t hang around.

Next time we’ll take a visual tour of the building before any of the work was done and cover in detail the process of building a thriving community resource. I’ll also tell you the real reason I couldn’t let anyone else buy this building…